Singlife Whole Life (previously known as Aviva MyWholeLife Plan IV) provides comprehensive lifetime protection options to boost coverage when it really matters. Even better, accumulate cash value for future life goals or your retirement.

Singlife Whole Life product details

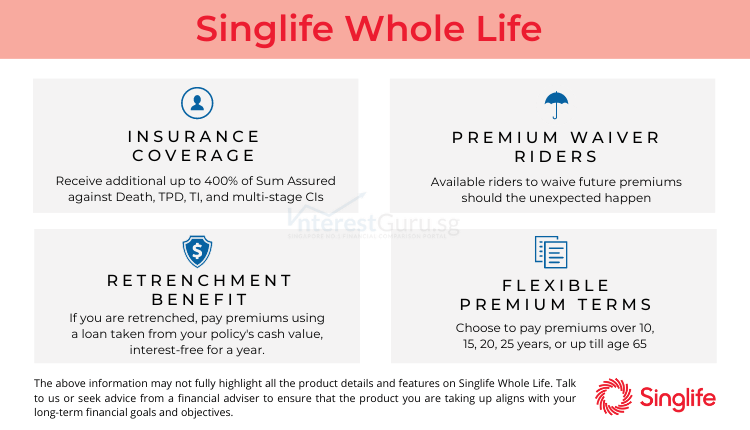

Singlife Whole Life retains all the features and benefits of Aviva MyWholeLifePlan IV with added benefits and options at competitive pricing.

Read About: 3 Best Whole Life Plan in Singapore for Insurance Coverage (Updated)

- Life policy – Whole Life Policy

- Insurance Coverage

- Be covered against Death and Terminal Illness

- Be covered against Total and Permanent Disability, Early Critical Illness, and Critical Illness with the available riders

- Coverage Multiplier Benefit

- You can choose to boost your coverage 2 to 4X of the Sum Assured to ensure you are well covered should the unexpected happen

- You can choose for your multiplier coverage to last up till age 65, 70 or 75

- Flexible Premium Term

- You can choose to pay premiums over 5, 10, 15, 20, 25 years or up till age 65

- Guaranteed Extra Protection Option

- Increase your coverage at key life events (eg. marriage, newborn child or graduation) without evidence of good health

- Retrenchment Benefit

- Premiums will be put on hold and interest waived for a year in the event you lose your job

- Income Payout Option

- Upon reaching age 65, you can choose to receive monthly income up to age 99

- Special benefits (Up to 6 times) allow claims of an additional 20% of chosen Sum Assured for 24 medical conditions such as diabetic complications or autism)

- Optional MultiPay CI Cover II rider for enhanced critical illness coverage.

Discontinued feature of Singlife Whole Life

- MultiPay CI Cover II Rider – A multi claims rider that pays out up to 5 times of Sum Assured across all stages of Critical Illness.

Get 20% of Sum Assured value for MultiPay CI Cover II if Life Assured did not make any claims before the policy anniversary provided that:

Life Assured is 65 ANB (for policy term that covers up to 70 ANB) or Life Assured is 70 ANB (for policy term that covers up to 85 ANB) without reducing the Sum Assured of MultiPay CI Cover II.

Features of Singlife Whole Life at a glance

Refer to below for a simplified overview of Singlife Whole Life:

Cash and Cash Withdrawal Benefits

Cash value: Yes

Cash withdrawal benefits: No

Health and Insurance Coverage

Death: Yes

Total Permanent Disability: Yes (With added riders)

Terminal Illness: Yes

Critical Illness: Yes (With added riders)

Early Critical Illness: Yes (With added riders)

Health and Insurance Coverage Multiplier

Death: Yes (With Multiplier rider)

Total Permanent Disability: Yes (With added riders)

Terminal Illness: Yes (With added riders)

Critical Illness: Yes (With added riders)

Early Critical Illness: Yes (With added riders)

Optional Add-on Riders

Total and Permanent Disability Advance Cover III

Critical Illness Advance Cover III

Early Critical Illness Advance Cover III

Critical Illness Premium Waiver

Payer Critical Illness Premium Waiver

Payer Premium Waiver Benefit

For further information and details, refer to Singlife website. Alternatively, fill up the form below and let us advise accordingly.

Policy Illustration for Singlife Whole Life, Yuki

Yuki, age 25, purchases Singlife Whole Life with a base Sum Assured of S$100,000 against Death and Terminal Illness, 3X multiplier coverage, and riders to cover herself against Total and Permanent Disability (TPD), Early Critical Illness (ECI), and Critical Illness (CI). She chooses to pay premiums over 15 years with a yearly premium of S$3,334.20.

At age 40, with a total of S$50,013 paid in premiums, Yuki finishes paying premiums and will continue to enjoy coverage for the rest of her life.

At age 70, Yuki’s Singlife Whole Life multiplier coverage ends. Her coverage amount reverts to the base sum assured of S$100,000 against Death, TPD, and Terminal Illness and S$30,000 against Early Critical Illness and Critical Illness.

At age 75, Yuki chooses to surrender her policy. She receives a projected surrender value of S$137,343 consisting of guaranteed cash value and non-guaranteed bonuses to spend as she wishes.

Policy Illustration for Singlife Whole Life, Rose

Rose, age 25, purchases Singlife Whole Life with a base Sum Assured of S$150,000 against Death and Terminal Illness, 3X multiplier coverage, and riders to cover herself against TPD, ECI and Critical Illness. She chooses to pay premiums over 15 years with a yearly premium of S$4,431.70.

At age 40, with a total of S$66,375.50 paid in premiums, Rose finishes paying premiums and will continue to enjoy coverage for the rest of her life.

At age 70, Rose’s Singlife Whole Life multiplier coverage ends. Her coverage amount reverts to the base sum assured of S$150,000 against Death and Terminal Illness, S$100,000 against TPD, and S$30,000 against Early Critical Illness and Critical Illness.

At age 75, Rose chooses to surrender her policy. She receives a projected surrender value of S$206,014 consisting of guaranteed cash value and non-guaranteed bonuses to spend as she wishes.

Key Difference in Yuki’s and Rose’s Singlife Whole Life Journey

Rose pays a higher yearly premium with a higher base Sum Assured (SA) of S$150,000 against Death and Terminal Illness(base plan) whereas Yuki’s base SA is only S$100,000 for her base plan with the same coverage for TPD, ECI and CI as Rose.

Yuki pays a total of S$50,013 in premiums for her coverage and Rose pays a total of S$66,375.50 (S$16,362.50 more than Yuki) to enjoy her higher base coverage

At age 75, Yuki and Rose both surrender Singlife Whole Life. However, Rose receives S$68,671 more than Yuki in the projected surrender value.

By increasing the base sum assured for the policy(not riders) we can see that Rose receives a more significant surrender amount compared to Yuki.

This is because only the premiums of the base policy go to work when it comes to accumulating cash value in a whole life policy.

In essence, Rose received S$68,671 more than Yuki by increasing her base coverage which only cost her an additional S$16,362.50.

Singlife Whole Life may be suitable if you are looking for

Singlife Whole Life may potentially be a good fit if the following matters to you:

- Higher protection for Death and Terminal Illness coverage at an affordable premium.

- Highest Early Critical Illness, Critical Illness, and Total Permanent Disability coverage in an Insurance Policy.

- Health and Protection coverage due to a shortfall in your Insurance Portfolio.

- Accumulating cash value in the policy for financial returns in the long term.

- Paying premiums only for a limited number of years and enjoying coverage for a lifetime.

Read About: How much insurance coverage do you really need in Singapore (Updated)

In-depth Review: Term life vs Whole life – Which is better for you?

Singlife Whole Life may not be suitable if you are looking for

Singlife Whole Life may potentially be a bad fit if the following matters to you:

- Liquidity or flexibility of withdrawal in your insurance policy.

- Access to cash from your policy on a regular basis.

- Insurance policy with a high surrender value in the early years of the policy.

- Potentially higher financial returns compared to a pure investment product.

For pure insurance savings or investment plans, please refer to the following policy reviews:

In-depth Review: 4 Best Endowment Savings Plans in Singapore with Lifetime Wealth Accumulation (Updated)

In-depth Review: 6 Best Investment Linked Policies in Singapore for Wealth Accumulation (Updated)

Further considerations on Singlife Whole Life

- How is Singlife or Singlife Whole Life investment returns based on historical performance?

- How does Singlife Whole Life compare with Whole Life Policies from other insurance companies?

- Can Singlife Whole Life fulfill my financial insurance, health, and protection needs?

- How does the multiple claims rider for various stages of Critical Illnesses work?

The above information may not fully highlight all the product details and features on Singlife Whole Life.

Talk to us or seek advice from a financial adviser before making any decision about Singlife Whole Life.

Read About: Where do you start with financial planning?

Is Singlife Whole Life suitable for you?

Contact Us!

Or Whatsapp us to let a licensed financial adviser work out a proposal at no cost to you.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

We compare quotations head to head on all leading insurers in Singapore

Our Partners

Our Partners