Planning for retirement in Singapore can feel overwhelming, especially with so many insurance companies offering different annuity and savings plans. While CPF LIFE provides a basic safety net, many Singaporeans worry it won’t be enough to maintain their desired lifestyle. That’s why more people are exploring the best retirement plans in Singapore that offer guaranteed income, flexible payouts, and added protection. In this 2026 guide, we compare the top options, highlight their key features, and help you decide which plan suits your financial goals.

Table of Contents

Why You Need a Retirement Plan

While CPF LIFE offers a basic safety net, most Singaporeans find it insufficient to cover lifestyle and healthcare expenses during retirement. Here’s why private retirement plans are worth considering:

Inflation Protection – Savings alone often lose value against inflation.

Guaranteed Income – Annuities provide stable monthly payouts for life or a fixed period.

Flexibility – Choose payout age, duration, and premium terms to suit your financial needs.

Family Protection – Many plans offer death or disability benefits alongside retirement income.

For this comprehensive review, InterestGuru.sg looks into the best retirement plans in Singapore that provide the highest income payout toward meeting your lifestyle needs and expenses.

- Best Retirement Plan for Disability Benefit – Manulife RetireReady Plus III

- Best Retirement Plan for Flexibility – NTUC Income Gro Retire Flex Pro II

- Best Retirement Plan for Lowest Premiums – China Taiping i-Retire II

- Best Retirement Plan for Guaranteed Payout – Singlife Flexi Retirement II

Related article: The Complete Guide to Retirement Planning

What makes a good retirement plan or annuity policy?

The main objective of a retirement plan or annuities would be to provide a consistent stream of income starting from your preferred retirement age. Ideally, a shorter premium tenor would provide the highest yield to the maturity of the policy.

When comparing retirement or annuity plans in Singapore, evaluate them based on:

- Guaranteed vs Non-Guaranteed Payouts

- Guaranteed portion = stability.

- Non-guaranteed bonuses = potential upside, but not assured

- Premium Payment Options

- Single premium (lump sum) vs limited pay (5–20 years)

- Payout Flexibility

- Choice of when your income starts to payout

- Duration: fixed term or lifetime income.

- Protection Benefits

- Disability income benefitDeath benefit for dependents

- Surrender & Liquidity

- Can you access funds early if needed?

👉 Compare retirement plans & view premiums now!

Read also: How pre-exisiting medical conditions can affect your insurance application

With all insurance companies in Singapore offering their retirement annuities, make sure you select only the best for yourself!

Best Retirement Plans in Singapore (2026)

Below is a comparison table summarizing top contenders:

| Plans | Best for | Premium Options | Payout Features | Notable Benefits |

|---|---|---|---|---|

| Manulife RetireReady Plus III | Disability Coverage | SP, Limited pay (5-20 years) | Lifetime income or fixed term | Disability rider embedded in plan |

| NTUC Income Gro Retire Flex Pro II | Flexibility | SP, Limited pay (5-20 years) | Lifetime income or fixed term | Optional riders |

| China Taiping i-Retire | Highest non-guaranteed income | SP, Limited pay (5-15 years) | 10, 20 or 30 years | Simple and no frills |

| Singlife Flexi Retirement II | Highest guaranteed income | SP, Limited pay (5-25 years) | Lifetime income or fixed term | Optional riders |

Basics of retirement planning: How does a retirement plan work?

Basics of retirement planning: When should you start saving for your retirement?

The best retirement plans based on features and income payout

In no order of preferences or ranking, we present the best retirement plans that offer a stream of the highest income payout to meet your retirement needs.

As your retirement goals and objectives are unique based on your individual expectation, ensure that your retirement plan is customised to fit your lifestyle needs.

Best Retirement Plan for Disability Benefit – Manulife RetireReady Plus III

Manulife RetireReady Plus III is a retirement income plan that gives you the flexibility to choose:

- Your desired retirement age at 55. 60, 65 or 70 years old

- Income payout period of up to 80, or up to 90 or for a lifetime

- Your desired amount of monthly guaranteed income

- Your desired premium payment term of 5, 10, 20 years or single premium (SRS option available)

What’s NEW in Manulife RetireReady Plus III:

- Retrenchment benefit is now 50% of your annual premium (up from 40% with RetireReady Plus II)

RetireReady Plus III will be 100% principal guaranteed upon retirement age and comes with Loss of Independence Benefits which is equivalent to your monthly guaranteed income payable should you not be able to perform 3 out of 6 Activities of Daily Living (ADLs).

Should you be unable to perform at least 2 of 6 ADLs, the monthly guaranteed income payable will still be increased by 50%. RetireReady Plus III is also a hassle-free application. There is no need for health underwriting and it also provides a premium waiver should you be disabled during the premium payment period.

In-depth financial details for Manulife RetireReady Plus III

At age 35, Ben purchases Manulife RetireReady Plus III to plan for his retirement. He pays a yearly premium of S$17,359 for the next 10 years.

With S$173,590 paid in premiums, the policy continues accumulating cash value with no further financial commitment until the chosen retirement age. At age 66, Ben starts receiving a projected retirement monthly income of S$2,702.50 ($1,000 guaranteed & $1,702.50 non guaranteed) for the next 20 years.

By age 85, Ben received a total of S$648,600 in projected retirement income ($240,000 guaranteed & $408,600 non-guaranteed) with only S$173,590 paid in premiums, a good 373% return on his investment.

Conclusion of Manulife RetireReady Plus III

You will receive additional monthly retirement income if you become disabled with the RetireReady Plus III’s inclusive disability income benefit.

What we like about Manulife RetireReady Plus III

- Single premium option available

- You can choose to pay your premiums using cash or CPF SRS account

- Income payout period can go as long as for life

- 100% principal guaranteed upon reaching retirement age

- No health underwriting needed

- Option to receive a non-guaranteed bonus in a lump sum or spread it into your monthly income at retirement age

- 1.5X of Monthly Guaranteed Income – Upon unable to perform 2 out of 6 ADLs

- 2X of Monthly Guaranteed Income – Upon unable to perform 3 out of 6 ADLs

- Retrenchment benefit the sum of 50% your yearly premium

What we do not like about Manulife RetireReady Plus III

- Retirement age is fixed in blocks of 5 years starting from 55 years old. Policyholders could not choose retirement age below 55 years old, or choose to retire at a specific age

More about: Manulife RetireReady Plus III (The complete policy review)

Spoilt with choices? Do not know what to choose? Fret not! Whatsapp us to let our friendly but Professional Licensed Financial Adviser understands your needs and work out a FREE comparison proposal for you.

Best Retirement Plan for Flexibility – NTUC Income Gro Retire Flex Pro II

NTUC Income Gro Retire Flex Pro II is Singapore’s only retirement annuity plan that allows you to change your chosen retirement age after policy inception. offering you flexibility should you wish to retire earlier or later.

NTUC Income Gro Retire Flex Pro II gives you the option to choose:

- Your preferred amount of monthly guaranteed income

- Your preferred number of years (10, 15, 20 years or till age 100) to receive your monthly payout

- Your preferred premium term varying from single premium, 5, 10, 15 or 20 years

Related article: 5 reasons you should invest in a retirement annuity plan

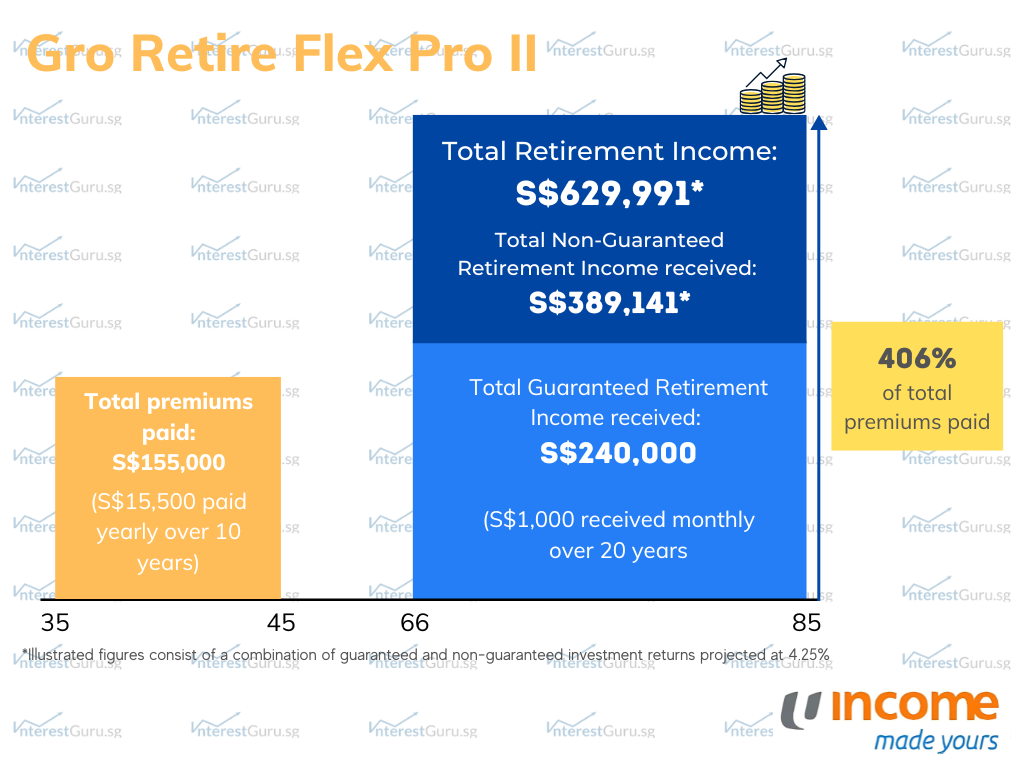

In-depth financial details for NTUC Income Gro Retire Flex Pro II

At age 35, Ben purchases NTUC Income Gro Retire Flex Pro II to plan for his retirement. He pays a yearly premium of S$15,500 for the next 10 years.

With a total of S$155,000 paid in premiums, the policy continues accumulating cash value with no further financial commitment until the chosen retirement age. At age 66, Ben starts receiving a projected average retirement monthly income of S$2625 (minimum of $1,000 guaranteed & average of $1,621 non-guaranteed) in the next 20 years.

By age 85, Ben will receive an estimated total of S$629,991 in projected retirement income with only S$155,000 paid in premiums, a good 406% return on his investment.

Conclusion of NTUC Income Gro Retire Flex Pro II’s Policy Illustration

What we like about NTUC Income Gro Retire Flex Pro II

- Flexibility to change your chosen retirement age if your retirement planning changes

- Income payout can go till age 100

- 100% principal guaranteed before reaching chosen retirement age, which means, if you need the funds early, you have the option to surrender it without losing your principal

- No health underwriting needed

What we do not like about NTUC Income Gro Retire Flex Pro II

- No SRS option for premium payment

- Defintion of disability is different from other insurers, disability is based on the defintion of loss of use of one limb, deafness, loss of speech and loss of sight of one eye

More about: NTUC Income Gro Retire Flex II (The complete policy review)

Spoilt with choices? Do not know what to choose? Fret not! Whatsapp us to let our friendly but Professional Licensed Financial Adviser understands your needs and work out a FREE comparison proposal for you.

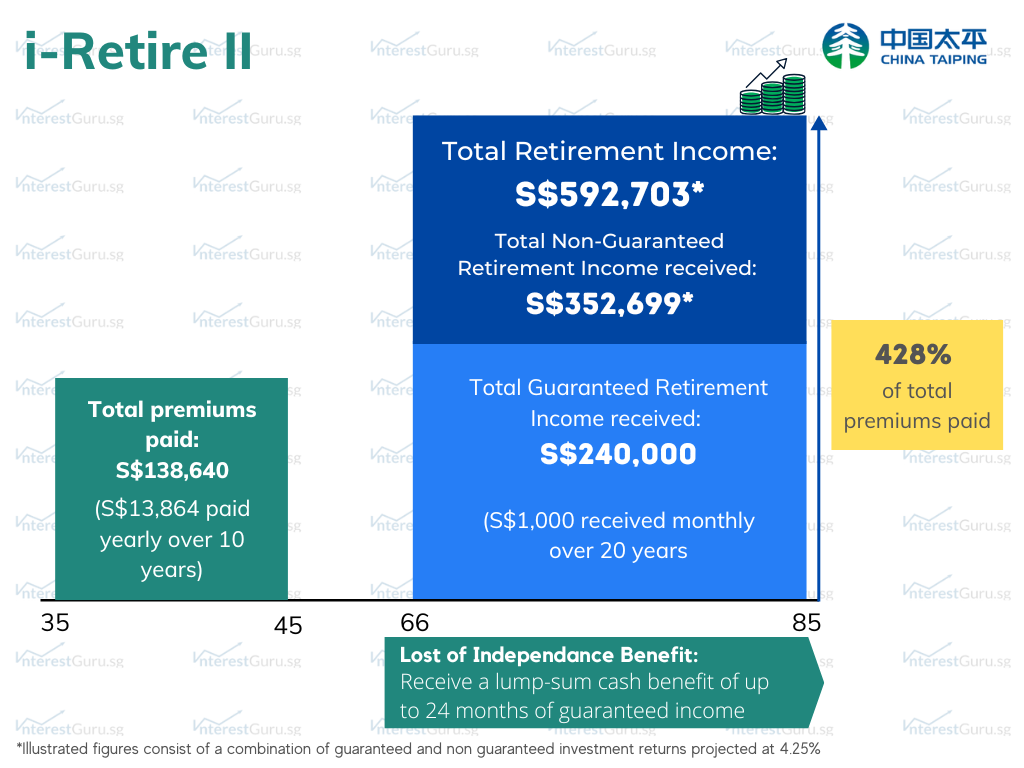

Best Retirement Plan For Lowest Premiums – China Taiping i-Retire II

China Taiping i-Retire II offers a no-frills retirement plan with premium payment terms ranging from a Single Premium, 5, 10, or 15 years,

China Taiping i-Retire II gives you the flexibility to choose:

- Your preferred premium payment term (5, 10 or 15 years)

- Your prefered payout term (10, 20 or 30 years)

- Your preferred guaranteed monthly income

In-dept policy illustration for China Taiping i-Retire II

At age 35, John purchases China Taiping i-Retire II to plan for his retirement. He pays a yearly premium of S$13,864 for the next 10 years.

With S$138,640 paid in premiums, John begins receiving a projected monthly retirement income of S$2,469.60 ($1,000 guaranteed & $1,469.60) per year for the next 20 years.

If Ben suffers an accident that causes him to lose his right limbs (or the equivalent), China Taiping i-Retire II will pay the Lost of Independance Benefit. In Ben’s case, he will receive 24 months of Guaranteed Monthly Income amounting to $24,000.

By age 85, Ben will receive a total of S$592,703 in projected retirement income ($240,000 guaranteed & $352,699 non-guaranteed) with only S$138,640 paid in premiums, a good 428% return on his investment.

Conclusions on China Taiping i-Retire II’s Policy Illustration

China Taiping i-Retire II is more affordable as its premiums are lower for its guaranteed monthly income.

What we like about China Taiping i-Retire II

- Best retirement annuity plan for people who do not need extra benefits, keeping costs low

- No medical underwriting needed to take up China Taiping i-Retire II

What we do not like about China Taiping i-Retire II

- China Taiping i-Retire II’s single premium option is not fundable with SRS funds

- Loss of independence benefit is not paid throughout the whole income payout period

More about: China Taiping i-Retire II (The complete policy review)

Spoilt with choices? Do not know what to choose? Fret not! Whatsapp us to let our friendly but Professional Licensed Financial Adviser understands your needs and work out a FREE comparison proposal for you.

Best Retirement Plan for Guaranteed Payout – Singlife Flexi Retirement II

Singlife Flexi Retirement II remains one of the most competitive annuities in Singapore. This is a regular premium retirement plan which you can customize based on your desired lifestyle and finances.

Singlife Flexi Retirement II will be 100% principal guaranteed upon reaching your chosen retirement age and comes with Care Income Benefits which is equivalent to your monthly guaranteed income payable should you not be able to perform 3 out of 6 Activities of Daily Living (ADLs).

Singlife Flexi Retirement II gives you the option to choose:

- Your preferred retirement age

- Your preferred amount of monthly guaranteed income

- Your preferred number of years (5 years or till age 120) to receive your monthly payout

- Your preferred premium term of single premium, 5, 10, 15, 20 or 25 years

- Hassle-free application – No health underwriting needed

In-depth financial details for Singlife Flexi Retirement II

At age 35, Carol purchases Singlife Flexi Retirement II to plan for her retirement, with an addition of the Care Income Plus Cover rider. She pays a yearly premium of S$14,318.20 for the next 10 years.

At age 66, Carol is eligible to receive a non-guaranteed bonus which she instead chooses to convert to additional monthly income.

With a total of S$143,182 paid in premiums, Carol starts receiving a total projected retirement income of S$2,119.60 per month ($1,000 guaranteed & $1,119.60 non-guaranteed) for the next 20 years.

Should Carol lose her ability to perform 2 of the 6 ADLs, she will receive an additional S$1,000 per month of retirement income. If she loses the ability to perform 3 of the 6 ADLs, she will receive an additional S$2,000 per month for as long as she stays disabled.

Otherwise, by age 85, Carol would have received a total projected S$508,700 in retirement income with only S$143,182 paid in premiums, a good 355% return on her investment.

Related article: How can I accumulate a million dollars (Realistically)

Conclusion on Singlife Flexi Retirement II’s Policy Illustration

What we like about Singlife Flexi Retirement II

- Flexibility to choose your retirement age. You do not need to choose between 55, 60, 65. You are free to choose when you want to retire or even retire earlier than 55 years old

- 100% principal guaranteed upon reaching retirement age

- No health underwriting needed

- Option to receive a non-guaranteed bonus in a lump sum or spread it into your monthly income at the start of your chosen retirement age

- Single Premium option is now available with the option of funding it with your SRS funds

What we do not like about Singlife Flexi Retirement II

- Disability income benefit has now become a rider, Care Income Plus Cover which you need to purchase for additional monthly income should you become disabled

More about: Singlife Flexi Retirement II (The complete policy review)

Which Plan Should You Choose?

Different retirement plans suit different needs. Here’s a profile-based recommendation:

For Stability Seekers → Singlife Flexi Retirement II (higher guaranteed payouts)

For Flexibility → NTUC Income Gro Retire Flex Pro II (can change chosen retirement age)

For Disability Coverage → Manulife RetireReady Plus III

For Yield → China Taiping i-Retire II (lowest premium, high non-guaranteed)

CPF LIFE vs Private Retirement Plans

CPF LIFE guarantees lifelong monthly payouts but is limited by your CPF savings. Private retirement plans complement CPF LIFE by:

Offering higher payouts if you can commit to premiums.

Providing extra protection (death, disability).

Giving you the flexibility to decide payout age and duration.

Tip: A balanced approach is to rely on CPF LIFE for basic expenses and supplement it with a private retirement plan for lifestyle and medical needs.

How do you get the most out of your retirement plan?

Your retirement plans are meant to supplement your lifestyle and expenses in your golden years. Find a retirement plan that pays out according to your life objectives before looking at the financial figures.

After all, the yields and the financial payout will not make a difference if the retirement plan does not allow you to utilize it according to your retirement lifestyle.

Related article: 5 reasons to invest in a retirement annuity plan *NEW*

Whenever possible, consider the following before taking up a retirement plan:

- Would you prefer a higher guaranteed or a higher overall non-guaranteed payout?

- Do you need the payout to increase at a fixed rate to keep up with inflation?

- In the event of disability or Critical Illness, do you still have to continue paying your premiums?

- What is the overall annualised yield on the retirement plan?

- Are you expecting a lump sum payout once you reach your retirement age?

- How much guaranteed and non-guaranteed are you expected to receive if you have to do an early surrender of your policy during your retirement years?

- In the event of disability during the payout period, is there any income multiplier to cover additional costs that will be incurred on your lifestyle?

FAQs on Retirement Plans in Singapore

1. How much do I need to retire comfortably in Singapore?

Depends on lifestyle. On average, we suggest a minimum of $2,000–$3,000 per month.

2. What’s the difference between CPF LIFE and private annuities?

CPF LIFE is mandatory and government-backed. Private plans are optional, flexible, and often offer higher payouts.

3. Are retirement plan payouts guaranteed?

Partially. All plans include a guaranteed portion, but non-guaranteed bonuses depend on insurer performance.

4. Can I get my money back if I surrender the plan?

Yes, but early surrender often means a loss. Best to stay invested until payout age.

5. When should I start buying a retirement plan?

The earlier the better — premiums are lower when you are younger and healthier.

Ensure that your retirement plan can address your retirement needs and concerns as much as possible. Due to the large financial commitment and long time horizon required, never compromise on what is important to you.

Final Thoughts

Retirement planning in Singapore is not one-size-fits-all. The best retirement plan for you depends on your retirement age goal, desired income, budget, and family needs.

If you value certainty, choose a plan with higher guaranteed payouts.

If you want flexibility, look at plans with customizable payout options.

Always review both guaranteed and non-guaranteed portions before deciding.

By planning early, you’ll not only secure your retirement but also give your family peace of mind.

Find the best retirement plans and annuity policies with the highest income payout here!

Contact Us!

Or Whatsapp us to let a licensed financial adviser work out a proposal at no cost to you.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

We compare quotations head to head on all leading insurers in Singapore

Our Partners

Our Partners

- Related Posts -

Is It Too Early to Start a Retirement Plan in Your 30s? (Singapore 2026 Guide)

The 30s Dilemma: “Too Early to Plan, or Too Late to Start?”If you’ve ever wondered whether...

- February 13, 2026

Insurance Planning for a Special Needs Child in Singapore: What Parents Need to Know

Planning for your child’s future is something every parent does — but when your child has...

- November 15, 2025

Best Retirement Plans in Singapore: 2026 Comparison & How to Choose

Planning for retirement in Singapore can feel overwhelming, especially with so many insurance companies offering different...

- January 9, 2026

3 Best Retirement Plans in Singapore with Lifetime Income (2026 Edition)

While there are many investment options when it comes to generating an income stream, few can...

- February 14, 2026