Best Critical Illness Plan in Singapore 2024

Better safe than sorry when it comes to critical illness

When it comes to the fight against Critical Illness, being prepared is as important as living a healthy lifestyle, exercising, and eating the right things. In this article, we have handpicked 3 best critical illness plans for your considerations.

According to statistics from the Ministry of Health (MOH), the top three causes of death in Singapore are Cancer, Pneumonia, and Heart Disease. Ensuring you have adequate coverage for hospital treatment bills and expenses is essential, allowing you to focus on recovery without financial worries.

Read about: Why an Integrated Shield Plan is essential (Payable via Medisave)

What is a Critical Illness Plan?

A critical illness plan provides a lump sum payment when you’re diagnosed with a covered critical illness. The table below shows you the standard list of critical illness that is covered. Do note that there are some additional critical illnesses that may be covererd by each insurer individually.

There are several types of critical illness plans provided in Singapore, and it can be tailored to your needs and budget.

Why do you need a Critical Illness Plan?

I have an Integrated Shield Plan, it is covering my hospital expenses. Why do I still need a Critical Illness Plan?

This is the most common question we get from clients.

A critical illness plan is designed to replace your income, not to cover hospital expenses. Treatments and medications for critical illnesses can leave you too exhausted to work, but your bills, children’s education loans, and allowances for your spouse or parents continue even if your income is reduced or stops.

An average person in their 40s needs at least 2-3 years to get back to what they are after battling with critical illness You never want to find yourself being caught off-guard and wrestling with a Critical Illness, even more so for recurrent illnesses. You may have the best health condition to fight it but the damage it does has taken a toll on an uncountable number of unprepared people.

Therefore, when looking for a Critical Illness insurance plan, if your budget allows, it’s wise to opt for a plan that allows you to make multiple claims against each diagnosis of Early, Intermediate, and Advanced stage critical illness.

Do note that it is also important to apply for a critical illness plan while you are in pink of health. Find out how Pre-exisiting medical conditions can affect your insurance applications.

Save the hassle, get your FREE Comparison Quote today and let us offer you the best deal according to your needs and budget with no strings attached.

Which Critical Illness Plan can you consider?

Interestguru.sg have shortlisted 3 plans to be the Best Critical Illness Insurance Plans in Singapore right now:

- Best Critical Illness Insurance Plan for Multiple Claims – Singlife Multipay Critical Illness

- Best Critical Illness Insurance Plan for No Frills Coverage – China Taiping i-Care

- Best Critical Illness Insurance Plan for Cancer Survivors – HSBC Life Cancer ReCover

Read along as we dive into the individual Critical Illness Plans to find out what makes these the best in Singapore

Best Critical Illness Insurance Plan for Multiple Claims- Singlife Multipay Critical Illness

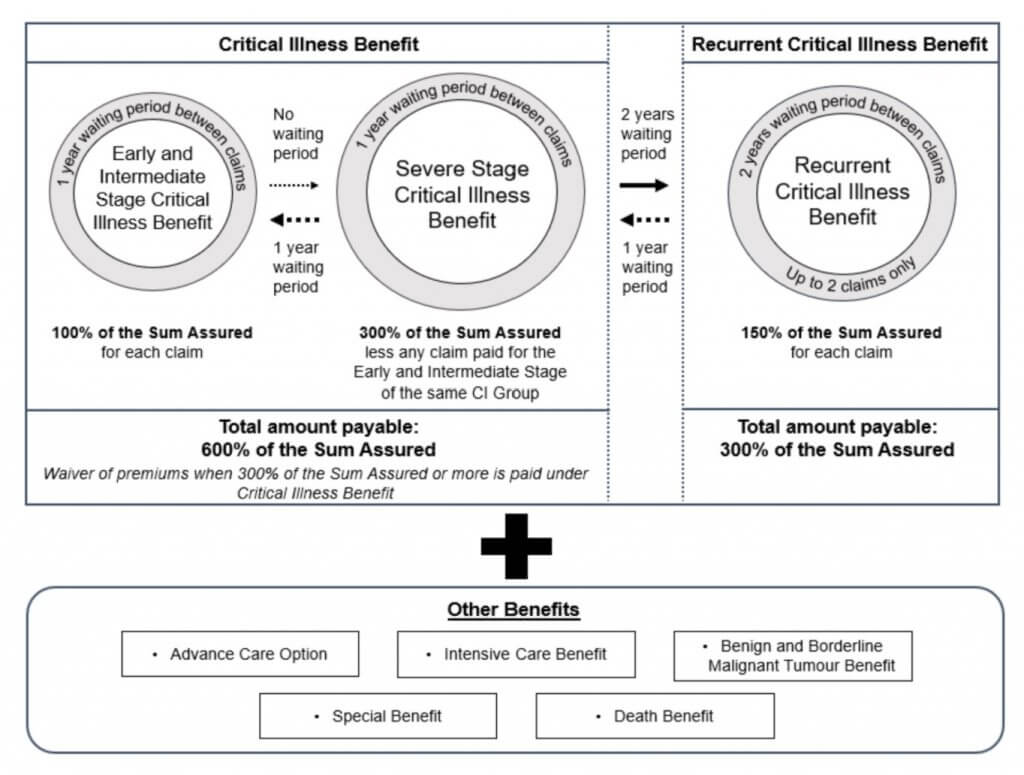

Singlife Multipay Critical Illness pays you up to 900% of the Sum Assured against 132 critical illnesses of all stages, the most out of the other plans compared here.

There is also an additional 20% of Sum Assured coverage against 11 juvenile conditions and 16 special conditions such as Diabetic Complications, Addison’s Disease, and Dengue Haemorrhagic Fever.

One of the most attractive feature of Singlife Multipay Critical Illness is there is no waiting period between an Early Stage Critical Illness and Severe Stage Critical Illness claim. This means you do not have to worry about your Multipay Plan being unable to cover claims if an illness progresses rapidly.

Below is a graph of how Singlife MultiPay Critical Illness works:

What we like about Singlife Multipay Critical Illness

- Covers the most number of Critical Illnesses of all stages

- You can make multiple claims up to 900% of the Sum Assured (600% for Early to Intermediate Stage critical illnesses, 300% for Advanced stage critical illnesses)

- Future premiums are waived when you successfully claim 300% of the Sum Assured

- Covers an additional 20% of the Sum Assured against 11 juvenile conditions (up till age 18) and 16 special conditions (up till age 85 or end of the policy, whichever first), up to S$25,000 per claim, 6 claims max

- Additional coverage of 20% of the Sum Assured upon a completed surgical removal of a benign tumor (suspected malignancy), up to S$25,000

- Receive 20% of the Sum Assured if you stay in the ICU for 4 days or more due to accident or illness, up to S$25,000

- Death Benefit of $5000 during the coverage term

What we don’t like about Singlife Multipay Critical Illness

- Low death benefit of S$5000

- Slightly higher in premiums than their competitors, but compensated by excellent features

For the full product review, view here: Singlife Multipay Critical Illness

Other similar plans that you can consider

Spoilt with choices? Do not know what to choose? Whatsapp us to let our friendly but Professional Licensed Financial Adviser understands your needs and work out a FREE comparison proposal for you.

Read also: What is a term life plan and when might you need one?

Read also: 5 Best Term Plans (2024 Edition)

Best Critical Illness Insurance Plan for No Frills Coverage – China Taiping i-Care

Working out a Critical Illness Coverage with limited budget? You may wish to consider China Taiping i-Care, the most affordable Critical Illness plan that is pocket friendly! China Taiping i-Care effectively covers the essentials without straining your budget. Remember, financial planning should not compromise your financial stability!

China Taiping i-Care covers you against 161 medical conditions. Choose coverage term of up to age 75, 85 or 99, with sum assured choice of $100k, $200k or $300k.

Similar to Singlife Multipay Critical Illness Plan, there is also an additional 20% of Sum Assured coverage against 12 juvenile conditions and 12 special conditions such as Diabetic Complications, Kawasaki Disease, and Dengue Haemorrhagic Fever.

As simple as that, China Taiping i-Care provides you the basics of what you need to be covered, straightforward and budget- friendly.

What we like about China Taiping i-Care

- Simple no frills Critical Illness Plan

- Provide coverage against 161 conditions

- Additional 20% of the Sum Assured coverage against 12 juvenile conditions and 12 special conditions, up to S$25,000 per claim, 5 claims max, only 1 claim per condition

- Chosen sum assured also covers Death if no Critical Illness claims were made

What we don’t like about China Taiping i-Care

- Maximum sum assured of $300k

- Inflexible policy terms ; only 3 coverage terms available, Age 75, 85 or 99. You cannot customised the plan according to your needs

For the full product review, view China Taiping i-Care

Read also: What is a whole life plan and when might you need one?

Other similar plans that you can consider

Spoilt with choices? Do not know what to choose? Fret not! Whatsapp us to let our friendly but Professional Licensed Financial Adviser understands your needs and work out a FREE comparison proposal for you.

Best Critical Illness Insurance Plan for Cancer Survivors – HSBC Life Cancer ReCover

Insurers often deny or exclude coverage for pre-existing conditions, particularly conditions that are prone to complications or likely to recur. Struggling to secure coverage for potential recurrent cancer to safeguard your financial stability? HSBC Life Cancer ReCover may be the only one plan that you can look for after winning the battle against Cancer.

HSBC Life Cancer ReCover plan is the first in Singapore that allows Cancer Survivors to get themselves financially protected from recurrent or newly diagnosed cancers.

Do note that HSBC Life Cancer ReCover plan is designed for Cancer Survivors whom are in remission for at least 3 years, a healthy individual will not be eligible to apply for HSBC Life Cancer ReCover.

HSBC Life Cancer Recover provides coverage against Death or Terminal Illness and across all stages of Cancers.

What we like about HSBC Life Cancer ReCover

- Provides coverage for Cancer Survivors

- Free child cover for advanced stage cancer

- Waiver of premiums for 24 months if diagnosed with Early or Intermediate Stage Cancer

What we don’t like about HSBC Life Cancer ReCover

- This plan only provides coverage for Cancer conditions

- Capped claim limit for every claim

For the full product review, view here: HSBC Life Cancer ReCover

Read also: Term life vs Whole life, find out which is the best for your situation?

Read also: How can I accumulate a million dollar (Realistically)

Spoilt with choices? Do not know what to choose? Fret not! Whatsapp us to let our friendly but Professional Licensed Financial Adviser understands your needs and work out a FREE comparison proposal for you.

An alternative to Critical Illness Insurance Plans: Whole life insurance plans

A whole life insurance plan can give you financial coverage and help you accumulate cash value at the same time. Upon reaching age 70 or so when you no longer need financial protection, you can choose to surrender the policy and receive the policy cash value to spend as you wish. The surrender value may even be more than the premiums you had paid.

You heard it right. Unlike term life insurance plans that expires upon policy maturity with no cash value, a whole life insurance plan covers you AND grows your wealth at the same time!

A standard whole life plan covers you against Death and Terminal Illness but riders can be added on to receive coverage against:

- Total and Permanent Disability (till age 70 or more)

- Early Critical Illness

- Critical Illness and

- Recurring Critical Illnesses

Read about: 3 Best Whole Life Plans in Singapore to plan for the long term (2024)

An alternative to Critical Illness Insurance Plans: Term Life Insurance Plans

A term life insurance plan can also provide a high level of coverage for all your insurance coverage needs, for an affordable yearly premium. Your coverage amount can be customised based on your needs, including but not limited to the following:

- Death

- Total and Permanent Disability

- Critical Illness

- Early Critical Illness

Similar to a critical illness plan, a term life plan also does not accumulate cash value over time. This means that the premium paid for the period of coverage is not recoverable if no claims were made from the term life plan.

Read about: 5 Best Term Life plans in Singapore for Term Coverage (2024)

Which Critical Illness Insurance Plans are the most suitable for you?

Contact Us!

Or Whatsapp us to let a licensed financial adviser work out a proposal at no cost to you.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

We compare quotations head to head on all leading insurers in Singapore

Our Partners

Our Partners