All you need to know about the MediShield Life upgrade, and why you should be covered by an Integrated Shield Plan.

Do you need an Integrated Shield Plan (ISP)?

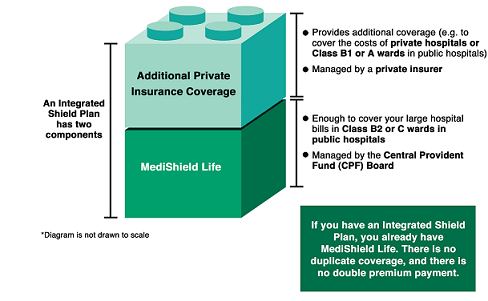

An Integrated Shield Plan (ISP) is an add-on upgrade from a private insurer to your MediShield Life. It is a medical insurance plan which offers additional medical benefits on top of the basic coverage provided by MediShield.

Hospitalisation and medical coverages can be broken down into 3 main parts: MediShield Life, Integrated Shield Plan and Integrated Shield Plan rider. At no point in time, will there be OVERLAPPING of coverages with either of the 3 parts involved.

MediShield LIFE

MediShield LIFE from the base component of your hospitalisation and medical treatment coverage. The provided subsidies are generally sufficient (according to MOH) for medical bills for Class B2 or C wards in public hospital. With just MediShield LIFE alone, you have to come out with the following when hospitalised:

- Deductibles (up to the first S$3,000 of the medical bill)

- Co-insurance (up to 10% of claim amount)

Deductibles and Co-insurance can be paid by MediSave, failing which cash payment has to be made.

Integrated Shield Plan

An Integrated Shield Plan upgrades the coverage of MediShield LIFE to cover for hospitalisation and medical treatment in Class A or B1 in public hospital or standard ward of a private hospital. The insurance premiums for an Integrated Shield Plan are relatively affordable. This is due to being able to tap into the Additional Withdrawal Limits (AWL) on your MediSave to pay for the bulk of the insurance premium.

Deductibles and Co-insurance are still payable, as the main purpose is to cover for the reduced subsidies provided by MediShield LIFE (as you are staying in a higher classed ward).

Integrated Shield Plan rider

An Integrated Shield Plan rider further enhances the coverage of the Integrated Shield Plan by reducing your payment of Deductible and Co-insurance. The insurance premium for an Integrated Shield Plan rider must be paid fully by cash.

With an Integrated Shield Plan rider, your total out-of-pocket medical and hospitalisation expenses can be reduced to 5% of the total bill (limiting your liability up to $3,000 per policy year), if you sought treatment at a panel hospital.

Staying in a government hospital instead of a private hospital will result in a daily cash income to the policyholder. This reducing the claim amount paid by the Integrated Shield Plan provider.

Read about: Integrated Shield Plan: 4 things you should be aware of

Read about: 5 Reasons why an Integrated Shield Plan is your first priority *New*

Type of Integrated Shield Plan Coverage

There is mainly three level of Integrated Shield Plan coverage, starting from the most expensive option:

Private hospital: Stay up to class A in a private hospital

Restructured (public) hospital: Stay up to class A in a restructured (public) hospital

Standard ISP: Stay up to class B1 in a public hospital

Note: You may choose to be ward into a lower tier bedding if your ISP plan entitles to a higher bedding ward, but not the other way round.

Key features of an Integrated Shield Plan

Higher level of comfort

With all year round hot and humid weather in Singapore, do you always wish for air-conditioning wherever you are at? Here are two choices: between resting in the comfort of an air-conditioned room with better amenities or a 6 bedded fan ventilated room. Obviously, everyone will choose the former, especially if you are feeling unwell.

According to MOH statistics, more than 2/3 of the people surveyed chooses B2/C class wards when they are admitted to a hospital. Main reason includes the follow: Hospitalisation costs, surgery and treatment cost and post-hospitalisation follow-up expenses.

Shorter wait time for operation

The average wait time for an operation in a public hospital is approximately between 4 to 6 months? This is due to the long queue for operations and availability of doctors. With all due respect, there has to be a trade-off between receiving subsided healthcare and level of treatment provided.

Waiting time for an operation in a private hospital usually goes no more than 3 weeks. Despite the shorter waiting time, there may even be a separate team of doctors on standby in case of any arising complication.

Pre and post hospitalisation coverage

Integrated Shield Plan also covers medical cost up to 12 months before and after the actual date of hospitalisation. No more worries about costly follow-up or being afraid of needing medical attention from a medical checkup.

No cash required

For most age group, Integrated Shield Plan is a cashless upgrade using funds in your MediSave account. Cash is only required to include the add-on rider to cover 95% of deductibles and co-insurance expenses.

Deductible – This is a fixed amount payable by the insured before the insurer pay for the remaining expenses. The deductible is capped at S$3,500 each policy year.

Co-insurance – A percentage (usually 10%) of the claimable amount which the insured have to pay on top of the deductible.

Cover 95% of medical expenses with an add-on ISP rider

An Integrated Shield Plan can a large part of the cost associated with your hospitalisation bill. But without deductible and co-insurance, you will still have to fork out slightly more than 10% of the total bill. This can be paid using your MediSave funds, failing the remaining has to be paid with cash.

With an ISP rider that covers 95% the deductibles and co-insurance charges, your out-of-pocket hopitalisation expenses are capped at $3,000 per policy year.

What are the available Integrated Shield Plans?

Without preferences and in no order of ranking, here are the 6 approved Integrated Shield Plan available in Singapore:

NTUC Income: NTUC Income Enhanced Income Shield

AIA: AIA HealthShield Gold Max

Singlife: Singlife Shield

HSBC Life: HSBC Life Shield

Prudential: PRUShield

Great Eastern: Supreme Health

Raffles Health Insurance: Raffles Shield

This list of Integrated Shield Plan is updated as of 18/08/2024

*Existing medical condition may be covered by moratorium underwriting, subjected to the insurance company discretion. An additional waiting period will be imposed before the existing condition is covered.

*Moratorium underwriting was only available for Aviva Integrated Shield Plans. It is now discontinued.

What should I consider when taking up an Integrated Shield Plan?

Nothing. If by now you still do not have an Integrated Shield Plan, go speak to a financial adviser now. We strongly believe that an ISP is a basic need and strongly encourage all readers to be covered by an ISP. With the correct ISP and add-on rider, you will be entitled to stay in the highest class ward 95% covered by your insurer.

Is an Integrated Shield Plan all you need for health and protection coverage?

While an Integrated Shield Plan and attached rider may cover your medical and hospitalisation expenses, there will be other parts of your lifestyle affected in the event of a major illness. Income will decrease during recovery or the job held prior may not be suitable anymore.

An Integrated Shield Plan does not replace your LOST EARNING or FUTURE INCOME.

If the budget allows, consider a Whole Life Policy or an Investment-Linked Policy which accumulates cash values while providing a lump sum payout when a major illness strikes. Alternatively, a Term Insurance can provide a short-term boost to your coverage despite having no cash value.

Read about: Whole Life Insurance: How does it work?

Read about: Investment-Linked Policy: How does it work?

Read about: Term Insurance: How does it work?

Find the best Integrated Shield Plan

Contact Us!

Or Whatsapp us to let a licensed financial adviser work out a proposal at no cost to you.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

We compare quotations head to head on all leading insurers in Singapore

Our Partners

Our Partners